Heritage Group

Our role as laser-focused gatekeeper for RMB project financing that makes a difference from action to reality:

In view of current global economic uncertainty and the hardest challenges, Heritage Funds LPF is driven by our purpose as one-of-a-kind differentiated solution to complex challenge to focus on Barter Trade Contract (BTC) with agility by solving big problems to shape a better RMB project financing solution for our project in hand. This well-established key to success, has evolved paramountly to our success. Heritage Funds LPF is the steadfast and delicate expert in leveraging RMB project financial instruments with deep understanding of Barter Trade Contract on government-to-government projects.

By being as a fiduciary to our project owners / employers / project holders, and by working collaboratively together with them with our ingenuity and big ideas for RMB project financing, we have partnered under trusted relationships with our Chinese related authorities, state-owned companies, financial institutions and Sinosure in compliance with Chinese related laws, regulations, codes, rules and guidelines to meet the RMB project financing requirements.

Thus as a strategic and hands-on private equity fund with our rigor, patience, and expertise approach and pathway, by exposing the bigger picture, by collaborating for better viable projects with Chinese powerful network, and by ringing by our true action of a promise made is a promise delivered, Heritage Funds LPF takes on these biggest opportunities and solves the most complex challenges in RMB project financing on government-to-government projects in the current global disruptive changes.

Your trusted partner with more than 13 years of practical experience in our deep, and enduring commitment to the integrated project financing solutions to serve your sophisticated needs.

Heritage Funds LPF

We see problem, solve problem, please explore how Heritage Funds LPF is leading the way of the project financing to our current government-to-government projects. Our core advantage is to use Barter Trade Contract (BTC) to tackle most important challenges and capture greatest opportunities by making the RMB project financing feasible, viable and bankable.

Welcome to our flat-management-style and consensus-driven Heritage group. Its Heritage Funds LPF is well known in its China NDA genes as rigorous, disciplined, thematic and innovative funds for systematically implementing our government-to-government projects on-time, and within budget.

Our competitive advantages, strengths & experience.

We uniquely are the “one-stop” platform for the trustworthy and compliant gateway to deliver project financing excellence.

Our project financing key differentiator, likes an everlasting tangible diamond! It fulfils the commitment of our project owners / employers / project holders, who could access to our RMB project financing structure over government-to-government projects.

Our focus on Hong Kong regulatory compliance in asset management, it is a reflection of the dedication to our government-to-government projects in hand.

We adapt the strategies, operation and investment approaches for our government-to-government projects to cope with the challenges and capture the opportunities amid the current global turbulence.

We operate independently and tailor the management of each fund to its unique investment mandate granted by our co-investors and our syndication banking group. We do not manage money on behalf of individuals.

Our key strengths have lied in its strategic partnerships with Chinese networks for China money for our project owners / employers / project holders.

Heritage group together with its Heritage Funds LPF (Limited Partnership Fund), is based in Hong Kong acting as a bridge by leveraging Hong Kong’s status as an international financial center.

As a preeminent & giant project financier with extensive China money fundraising ability, we work together with Chinese state-owned companies, Chinese funds, Sinosure, Chinese policy banks for our governmental project implementations.

Our proprietary network of distinguished relationships and certainty of capital, and the benefits of our project financing structural model, which marries third party capital with our own capital, it makes us uniquely positioned to access several pools of substantial capital from China and within Asia.

Heritage group started in 2012, since then, it has gone on to establish itself as a credible, high conviction and value-adding investor together with China money from its Chinese co-investors to the government-to-government projects. It has grown successfully already. Our success story has been based on our proven skills, our expertise, and our entrepreneurial attitude. It has been directly supported by our strong China DNA and its network of connections in today China’s dynamic project financing environment.

Today, we have a pragmatic & firm focus on networking with the top governmental leadership. We strive to provide our best-in-breed partners / project owners / employers / project holders for a better and smart a-z solution of fundraising, financing, execution, and completion of our government-to-government (G-to-G) projects. Such solution includes the signing ceremony of order-intake agreement, import quota approval, limited partnership agreement, and EPC consortium agreement with all parties concerned. The objective is to ensure it has done on-time, and within budget by our differentiated approach to G-to-G projects.

We only do this one thing. In pursuit of this, and in doing so, we are energized to take a very hands-on and extensive in our on-the-ground and thoughtful approach. We have established ourselves as the leader in what we do in project financing. We pride consistently ourselves for the diligent work ethic with proven results and a solid track record over 13 years in the past at the heart of government-to-government projects. We have developed unique expertise in what we do it best.

We solely stay true to our such core principle. We always do it. Therefore, success doesn’t happen by accident. For us this path has not been a linear one. It is riddled with challenges in an upward spiral from uncertainty, lag, angry, bitter, pessimistic, resentful, rejection, exhaustion, to optimistic, pride, elation and glorified. Now, we have a proven methodology for achieving enduring excellent results rooted and based on three key distinct characteristics and criterion to add genuine value:

China money financing & its connection network, project implementation know-how technology, and a very good brain.

In all our endeavours, our word is our bond and promise, we keep it, we live up what we commit, at our heart only has one thing: our mandate is very clear with adherence to our highest standards of integrity at the heart of everything we do.

Our value prop & strategy are always this action to inspire our efforts and guide our decisions:

We only persevere, systematically focusing on government-to-government projects to create the greatest value possible. This is matter what Heritage Funds LPF always does! This is our purpose. We always stay steadfast and relentless in it.

Feel & experience the difference: Himalayas remarkable inspiration from climb to climb to the top of mountain, it has been always in our ethos and DNA, it is what makes us evolving into more great champion.

Also, project financing is an art, we paint and craft thoughtful, rigorous, and precise solutions for our government-to-government projects.

We’ve been entrusted as an independent fund for over 13 years, investing into government-to-government projects together with our co-investors.

Facts at a Glance

As at 28th Feb 2025

Focus on the governmental project financing

Year Legacy of Triumphs in Project Financing

Chinese Action Partners

Accumulated Projects USD

Flagship with Bank Credit Line Euro

Our motivation is empowered by a full excitement of working with the most distinct governmental top leadership networks. It is always with the success stories tomorrow.

impactful and leading cross investment partner

Heritage Funds LPF operates on a trusted and reputable Chinese platform. We enter strategically into a series of the appropriate valuable long-term oil & LNG off-take agreement. These agreements serve as valuable tools. It allows us to leverage and exchange commitments into oil and LNG order-intake agreements. The primary goal is to utilize these agreements as collaterals to secure project financing. It ensures the seamless implementation of our projects.

This unique model has proven successful, particularly in collaboration with Chinese state-owned companies, financial institutions, and investors, as well as project owners / employers / holders. By consolidating our own resources with Chinese capital, we establish a robust financial partnership. We together with our partner’s commitment from China money, we are dedicated our involvement by investing up to 25% equity in Engineering, Procurement, and Construction (EPC) contracts. This model has been specifically tailored for Chinese state-owned companies involved in our project execution.

In our pursuit of optimization, we have developed and pioneered an attractive and thoughtful approach. The approach enhances the appeal of investing alongside Chinese capital in our governmental project portfolio. Taking a hands-on approach and taking a direct role in managing our government-to-government project assets, we actively manage our assets through both direct investment and fund-of-fund activities.

In summary and in essence, Heritage Funds LPF has earned an excellent reputation as a trustworthy, reliable, and well-respected Chinese DNA platform for government-to-government projects. For our track record and proficiency in executing government to government projects with China money for project owners / employers / holders, we have provided significant powerful competitive and strategic advantages. We firmly believe that our established credibility, has positioned us as a preferred partner in collaborative endeavors.

Government to government projects

In the realm of government-to-government projects, we pride ourselves on being distinguishes as a Chinese private equity firm with truly both China and the international reach. Collaborating closely with Chinese state-owned companies, policy banks, and Sinosure, we have demonstrated an unparalleled proficiency across developmental, evolutional, operational, financial aspects. From the way of origination to execution, underwriting, and financing, we bring forth exceptional expertise in driving forward for our government-to-government projects.

bridge – Super connectivity

Since the inception of Heritage group in 2012 in Hong Kong, we access and leverage our top leadership network from China to bridge the GCC countries and China. Renowned as a top-tier and prized Chinese private equity firm, Heritage Funds LPF along with its hands-on approach, we always act and serve as a vital “bridge” between Chinese governmental entities, sovereign funds, private investors and the project portfolio of our owners / employers / holders.

Key Differentiator focus

With our track & proven ability record spanning the past decade, our distinctive strength lies in our unparalleled capacity to attract Chinese capital. This has prompted Heritage Funds LPF to concentrate on project financing through collaborations with Chinese state-owned enterprises, Sinosure, Chinese policy banks, and global private equity firms. By mitigating project financing risks through sponsored guarantees, we have successfully broadened our portfolio of projects.

The above seeding empowers Heritage group robustly and effectively to provide a comprehensive wide array of tailored financing services to meet the specific fit-for-purposed demands and the unique conditions of government-to-government projects for the project owners / employers / holders.

We are committed to addressing project financing requirements across the needs in different phases and stages of project completion. We utilize local teams to gain deep insights and knowledge into the market dynamics of government-to-government project features. This approach enables us to accommodate a diverse range of specific requirements from project owners / employers / holders / stakeholders, We ensure that unique conditions are met with precision and flexibility.

Project Team

The team consists of a highly skilled, qualified, experienced, and seasoned group of professionals dedicated to ensuring that projects are executed with meticulous attention to detail.

Organization

We maintain a straightforward dynamic and simple organization structure, which contributes to our consistent, sound and effective operational performance.

Core Activities

Our primary focus lies in a variety of projects spanning from agriculture, energy, and infrastructure, environmental protection to diesel trading.

Branding & Vision

The origins of our distinctive red logo and branding are deeply rooted and integral in our Chinese heritage DNA, embodying our vision and values.

Flexible professional solutions to create something extraordinary.

CONNECTION

Specialist in Project Financing

In collaboration with Chinese state-owned enterprises, Sinosure, and policy banks, We boast abundant governmental resources coupled with extensive knowledge of China and global project financing markets. Our broad and deep contact network spans across both China and international spheres, offering a broad and profound reach for facilitating successful governmental projects.

compelling SOLUTION

Tailored Financial Solution

Heritage Funds LPF offers a diverse and wide range of customized, bespoke, comprehensive, and holistic financial solutions for project development and construction. With our fully integrated capital capabilities, we ensure the timely and budget-conscious completion and success of governmental projects undertaken by our Chinese state-owned partners. For example, we have a value-added creation solution for barter trade for our projects.

ABILITY

15%-25% of Funding

Our emphasis lies in furnishing project owners / employers / holders with project financing ranging from 15% to 25% for government-to-government projects. This is achieved through securing adequate value and establishing long-term off-take agreements for oil and LNG in exchange for projects, ensuring projects remain within acceptable risk parameters and tolerance.

We strive to be the best, and we aspire to excel and have emerged as a frontrunner in government-to-government projects. Leveraging our extensive network and exceptional cross-border capabilities, we are well-positioned to provide a comprehensive and full range of project finance solution to project owners / employers / or holders.

In essence, Heritage Funds LPF offers unique and distinctive synergies by employing our advice, financing, investment, transactional, management, and empowerment methodologies, delivering integrated one-stop project financing services to our project owners / employers / holders.

Licensing Information

Heritage Funds LPF is duly registered under the Limited Partnership Fund Ordinance (Cap. 637) of Hong Kong, with registration number 72665155. It enables us to engage in the fund management activities. Our operations are overseen by its General Partners (GP) of holding the SFC type 9 (asset management) license as the responsible officer (RO) status regulated by the Hong Kong Securities and Futures Commission, under registration CE number AZL662.

Furthermore, we are in the process of pursuing the Registered Fund Management Company (“RFMC”) Capital Market Services License under the Securities and Futures Act (Cap.289) (“SFA”) from the Monetary Authority of Singapore (“MAS”), allowing us to conduct fund management activities in Singapore.

Project Financing

Through collaboration with Chinese governmental authorities, policy banks, Sinosure, state-owned enterprises, international private equity firms, and co-investors, Heritage Funds LPF adopts a flexible approach to project funding cooperative programs.

We offer bespoke and customized project financing solutions tailored to the requirements of our project owners / employers / holders. Thus, our enduring commitment to a diversified approach to financing government-to-government projects is pivotal and essential for the success of our project owners / employers / holders.

Current projects in progress

Partners

Strategic action partners

Our professional networks and our Chinese strategic action partners, are our most valuable assets contributing through strategic partnerships with the signed consortium agreements in place with Heritage Funds LPF.

Our Chinese action partners are qualified EPC contractors with capabilities, knowledge, capacities and experiences to undertake and complete the entire projects. They carry out the preliminary design, detail design, project management, construction, completion, delivery and commissioning of the prestigious projects under the platform of Heritage Funds LPF.

Our active relentless drive for achieving and nurturing mutually beneficial relationships, it has been empowered by a full excitement and support of top governmental leadership networks.

Our interests with well-boned capabilities, are structurally aligned with Chinese investors / Chinese state-owned main contractors / the project owners / employers / holders and their local sub-contractors to move them forward.

Advisors & co-investors

Advisors

The advisors have unique, in-depth and extensive knowledge for the markets we operate in. Based on the accumulated experience of our Chinese investors, partners and advisors, we take pride in our tailored care specialist knowledge of local markets under the Belt and Road Initiative for overseas investment drive.

Together with our advisors, we always pay attention to our talents and our connections with project owners / employers / holders for making the success of frontier government-to-government projects by investing into the countries we operate in.

Co-investors

We, Heritage group with Heritage Funds LPF act as the General Partner (GP) and one of Limited Partners (LP). We adopt a co-investment model with its strategic co-investors, and peers. Such model contains a relationship with several comprehensive co-investors and strategic equity partners from China and international private equity firms as the Limited Partners (LP).

This always makes our government-to-government projects “investor-ready”. We as a bridge builder, develop such innovative frameworks to leverage China capital investment aligning to our core investment beliefs.

Past historical projects track records

Limited Partnership Funds (LPF)

Objective

Objective is to identify, structure, fund, develop, & provide hands-on project financing to create and deliver value under this sustainable fund platform for our governmental projects. Heritage Funds LPF are backed by Chinese private equity funds, sovereign funds with its Chinese policy banks and some of the global blue-chip co-investors.

Fund Models

It is led by one of its General Partners Lee Kwok Wan, who works on the compliance with the license of Type 9 (Asset Management) regulated activities by SFC, we work with the selected strategic Chinese & International co-investors. It is the one of the key investment models with Heritage Funds LPF.

Focus & Tasks

The key focus is on project value creation for its government-to-government projects. It should be within the measurable and controllable risk and the time frame given by its Chinese co-investors and the project owners / employers / holders. We also provide family trust establishment & management services as a total financial solution for our Chinese investors.

Funds

Being a Chinese private equity fund manager, its discretionary asset management mandate, is entrusted with the management of the funds via a unique and outstanding knowledge of the project market and an unrivalled network of contacts in its dynamic frontier governmental project markets.

You may also be interested in asking us:

What role does our Heritage group play in the business model?

Our Heritage group, in collaboration with its Heritage Funds LPF, exclusively focuses on government-to-government (G-to-G) projects. Our role involves providing 15% to 25% of the project value in capital, alongside offering our expertise to support the realization of these innovative and ambitious government-to-government projects, so that such ideas and bold projects take flight.

Heritage Funds LPF offers and employs the Barter Trade for Project (BTP) funding model when traditional loan arrangements between governments are not feasible.

Our focus is strictly on first-class project financing tailored specifically for government-to-government projects, only in a first class way ensuring the highest standards of execution.

How does our Heritage group add value to the project?

Our Heritage group, through its Heritage Funds LPF, brings a robust and responsible investing framework to the table. Led by one of its General Partner Lee Kwok Wan, we act with integrity as facilitators and financiers, particularly in collaboration with Chinese investors, while Mr. Lee is adhering to regulatory standards such as the SFC type 9 (asset management) license (CE: AZL662) regulated by the Hong Kong Securities and Futures Commission.

Our objective is always to provide tailor-made, happy, valid, integrated, comprehensive, and thriving turnkey project financing solutions for project owners / employers / holders in an efficient and effective way.

We conduct thorough due diligence to assess project opportunities, we capture and maximize value across a range of various strategic and operational levers in governmental projects.

Operating under the Heritage Funds LPF platform, we adapt and leverage a top-down leadership network approach and establish effective partnerships with Chinese state-owned entities for governmental projects. Such approach works well. Our project implementation follows an EPC+F (Engineering, Procurement, Construction, and Financing) basis in the countries where we are active, ensuring efficient and effective execution.

That is how we can add value to our project owners / employers / holders, as well to Chinese state-owned EPC companies.

Why has Heritage group been performing exceptionally well?

Yes, undoubtedly, Heritage group’s remarkable success is evident, underscored by a decade-long journey of achievement.

The central to this success is its ownership by core top Chinese shareholders, granting it a solid foundation. Moreover, the group boasts an excellent in-depth, extensive and profound personal network directly connecting with the highest echelons of governmental leadership in the countries where it operates.

Heritage Funds LPF stands out for its stellar performance, driven by a strategic blend of initiatives and operational capabilities. Notably, such strategies and functional capabilities have orchestrated the transformation of government-to-government projects into bankable project implementation in collaboration with Chinese state-owned EPC contractors, aligning investments with the objectives of project owners / employers / holders.

In expanding the value chain of China’s Belt and Road Initiative, Heritage leverages synergies across project intelligence, technical skill and prowess, international market acumen, and financial backing. This approach solidifies and fosters robust relationships with key governmental figures, further bolstering its position.

Diversification is a key pillar of Heritage’s success strategy, as evidenced by its array of financing and fundraising channels. From Sinosure to Chinese policy banks, international financial institutions, insurance firms, capital markets, and asset securitization, the group ensures ample resources are mobilized to realize projects in partnership with Chinese state-owned EPC companies, progressively advancing its objectives.

The culmination of these efforts has led to Heritage group’s most significant triumphs and deeply fulfilling achievements, marking it as a beacon of our greatest successes in its field.

Why opt for Heritage Funds LPF as your partner?

Powered by an outstanding over one decade-long involvement and network in government-to-government projects, we boast a strong track record and the solid reputation for collaborating with Chinese investors, particularly through our investments in government initiatives like the China Belt and Road projects. This unique alignment positions us as a reliable and distinctive partner, underpinned and built on a foundation of trust and credibility that has been pivotal to our success.

Everything we do is only focused on government-to-government projects. Our exclusive focus on government-to-government projects sets us apart as specialists in this niche market, providing unparalleled agility and expertise tailored specifically to this sector. Such strength makes us uniquely agile.

Heritage Funds LPF managed by General Partner Lee Kwok Wan, operates under the regulatory oversight of the Hong Kong Securities and Futures Commission (SFC), ensuring compliance with the highest standards of asset management (SFC type 9 license, registration CE number: AZL662).

We adhere strictly to statutory requirements, maintaining a high level of corporate transparency and implementing rigorous monitoring and risk control processes throughout project implementation.

Our commitment meticulously extends to offering tailored project financing advice and support at every stage of the governmental project lifecycle, catering to reach the unique goals and needs of project owners / employers / holders, and build partnerships that last decades.

Our track record speaks volumes, with numerous project awards earned in collaboration with Chinese state-owned EPC companies in the countries where we operate, underscoring our proven success and expertise in delivering impactful outcomes.

With us for the project financing, you will find a vast network of access, relationships, and opportunities well worth exploring.

Therefore, from humble roots, these above capabilities have enabled us to successfully meet a variety of challenges from the government-to-government projects.

How does Heritage Funds LPF Operate?

Heritage Funds LPF functions similarly to other managed investment schemes. Funds are generated through transactions facilitated by barter trade contracts for government-to-government projects, adhering to the conditions outlined in order-intake agreements, import quotas, and limited partnership agreements involving all relevant parties under one roof.

The generated funds are pooled and consolidated into a custodial account at the Bank of China Hong Kong. From there, the funds from the custodial account at Bank of China Hong Kong are directly disbursed to Chinese state-owned companies according to the construction schedule of Construction In Progress (CIP) outlined in the consortium agreements signed with project owners / employers / holders to carrying out their project implementation. This process ensures seamless project implementation in alignment with contractual obligations.

The operation of the Funds consists of:

- Heritage Funds LPF,

- Heritage Funds LPF – Cultural Impact & Philanthropic Fund,

- Heritage Funds LPF – Oil & Gas Fund, and

- Heritage Funds LPF – Pipeline Laying Fund (Registration in progress).

The above separate fund entities individually operate under the Heritage brand. They are each independently owned, have separate investment teams, manage their own funds, and make independent investment decisions.

Why does Heritage Funds LPF Choose Hong Kong as the Gateway for its Government-to-Government Projects?

Heritage Funds LPF selects Hong Kong as its gateway for government-to-government projects for several compelling reasons:

- Strategic Location: Hong Kong’s proximity to Mainland China provides convenient access to Chinese markets and decision-makers. Hong Kong is a unique position to being the gateway connecting the East and the West.

- Global Financial Center: Hong Kong is globally recognized as a premier financial hub, offering a wide range of financial services and expertise.

- Renminbi Clearing and Settlement: As a prominent clearing and settlement center for the Renminbi (RMB), Hong Kong facilitates transactions in China’s currency, supporting seamless financial operations.

- Offshore Renminbi Hub: Hong Kong serves as the world’s largest offshore Renminbi hub outside of Mainland China, facilitating Renminbi-denominated transactions.

- Support for Belt and Road Initiative: Hong Kong actively supports the China “Belt & Road” Initiative, leveraging its financial and professional services to capitalize on the vast opportunities presented by the initiative. By building on innovation of “Belt and Road” Initiative, Heritage Funds LPF is more like a marketplace of providing project financing services to the government-to-government projects.

- Regulatory Environment: Hong Kong offers a highly regulated environment that instills confidence among international investors, ensuring transparency and accountability in financial dealings.

- Legal Framework and Stability: Hong Kong boasts a robust legal framework and enjoys economic and political stability, bolstered by its affiliation with China.

- Corporate Governance: The city maintains rigorous corporate governance standards and adheres to international accounting practices, enhancing trust and credibility in the financial sector.

- Tax Incentives: Hong Kong provides favorable tax incentives for locally domiciled funds, including exemptions from capital gains tax and withholding tax on dividend income, both for residents and non-residents. Of course, its low tax rate impacts positively on net investment returns.

These factors collectively make Hong Kong an ideal choice for Heritage Funds LPF to conduct its government-to-government projects, ensuring efficiency, stability, and strategic advantages in its operations.

Have any more questions? Please drop us a line

Thank you for visiting Heritage group website. By underpinning the government-to-government projects in everything we do with commitment, please connect with us to transform your passion and idea into a real project. By connecting to Heritage group, you have connected with the government-to-government projects. It is your home for highlights about how the governmental project in one place for all the goals and all the actions, are implemented. Please tap into this power of one integrated solution website and you can obtain an insight of understanding how it works across the government-to-government projects.

Heritage

Homepage that best fits project financing for government-to-government projects

Solutions

SFC Licenses, Financing Methodology Uniqueness & Success Story

Project Financing & Fundraising Ability

Unique, Holistic & Impactful Approach to Value-oriented Creation via Barter Trade

Buyer’s Credit

Funds

Objective

Advisors

Co-investors

Fund Models

Focus & Tasks

Funds

Fund Ownerships

About us

What We Do

Qualified Team

Organization

Core Activities

Branding & Vision

Chinese Action Partners

Current projects

Project Brief vs Art Catalyst

Oil-in-exchange-for-refinieries and oil-in-exchange-for-oil-tanker-carriers

Solar Project

Railway Projects

Past projects

Solid Liquid Separation System

Pipe Plant

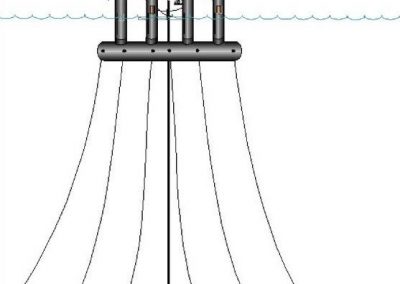

Submersible Drilling Unit

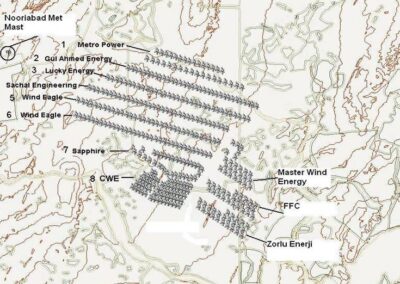

Wind Energy in Pakistan

Libyan Oil Tank Construction

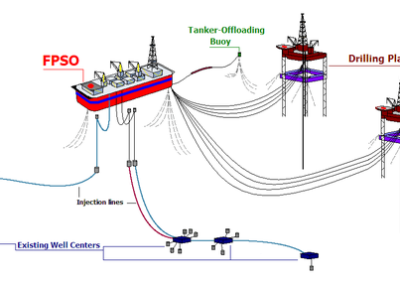

FPSO for Pemex Mexico

Airport in Somalia

Shipbuilding & Financing

Desert Irrigation

DISCLAIMER: This website has not been reviewed by the Securities and Futures Commission “SFC” of Hong Kong. The issuer of this website is Heritage Funds LPF. This website is solely aimed at providing for the informational purposes. Heritage Funds LPF is a subsidiary of Heritage Resources Ltd.