SFC Licenses, Financing Methodology Uniqueness & Success Story

In essence and put simply, we have effectively utilized successfully Chinese models, employing the top-down (up-to-bottom) and conviction-led style leadership skills, to drive our governmental projects forward.

Through our disciplined top-down approach, we find and identify project opportunities, then narrow it down and refine making them into specific, viable and bankable projects.

Investing in government-to-government projects is not only a passion, but also it offers opportunities and obligations. It requires an enduring commitment that demands our utmost care and attention at heart.

With a lot of our extensive hands-on experience in this realm, we provide invaluable advice and expert tailored project financing services, ensuring that our project owners / employers / holders / stakeholders achieve their funding goals.

WHY WE work in motion within our Disciplined top-down approach

In an increasingly competitive government-to-government project market, By collaborating with a group of our highly experienced local partners together with project owners / employers / holders, the top-down leadership approach can give us a distinct advantage when scrutinizing and hunting for the right governmental project opportunities. We can have discover enormous potential opportunity in the pursuit of the bankable, sustained, and strategic importance of projects in the country concerned.

In this highly competed market, where everyone has access to the same information, we thrive by not following the crowd, but we are positioned to help lead the way. As a top-down project financing provider, we uncover opportunities in areas where nobody else is looking, our independent thinking puts us in a space, where we face little competition to grab the mandate of the project financing directly, professionally and politically.

Going with such top-down human instinct approach to investing with China money into the governmental projects, it takes passion, practice, and commitment in our convictions. Heritage group has managed its China money this dynamic way for over 13 successful years. This delivers greater certainty for our sustainable success of Heritage group.

CONNECT WITH LOCAL PROJECT OWNERS / EMPLOYERS / HOLDERS

Heritage group, in collaboration with local partners and Chinese state-owned partners, works and engages directly with project owners / employers / holders, or through reputable local agents by offering them the most efficient project financing solutions available today. Our focus is on providing the most optimal strategic advice and legal guidance tailored to the unique financing components of their projects after having an in-depth understanding of their projects in view of our enduring relationships built on trust and honest counsel.

From the start and position themselves for success, we have no off-the-shelf “solutions”. But our challenge is to find a best-fit path for them with everything we could. We eschew one-size-fits-all solutions and instead seek to chart a new course that maximizes success. Our objective is to offer a shortcut to early success by identifying new paths and adapting speed and trajectory as when and where we need them most to do so. While recognizing that breakthrough ideas may initially be challenging to grasp, we tirelessly strive to secure project financing by any means necessary since we do whatever it takes to get the project financing in place.

Our commitment by doing the right thing for them, lies in aligning our thinking, capabilities, and methodologies with the needs of our project owners / employers / holders, with sole purpose to be compelling significant project changes and creating bankable projects for them.

Employing a robust operational approach, we focus on intrinsic value methodology from a top-down (up-to-bottom) perspective, collaborating closely with individual country leadership on government-to-government projects to mitigate risks.

We offer on-the-ground integrated solutions to support them every step of the way, bridging diverse perceptions and expectations among all the parties concerned to craft success stories.

Tailoring project financing strategies to meet specific demands and needs at various stages of project development and implementation of our project owners / employers / holders, we assist them in overcoming the challenge and assembling the right teams, financing models, and subcontractors.

In other words, we help them take on their biggest challenges to their individual government-to-government projects, knowing that part of their preparation requires capital. But it also requires the right mindset, building the right team, developing the right project financing models, and picking their overseas and local sub-contractors for the journey with the know-how for giving support and space to grow and learn to materialize the step-by-step for the completion of project implementation.

Our flexibility and creativity allow us to structure solutions for projects of the most complicated parameters and its varying complexity, earning us the trust of project owners / employers / holders as their preferred partner.

We play a vital role in helping them to realize their governmental project implementation into realities by offering innovative, unparalleled and to-the-point project solutions. Furthermore, we bring excellence in project management, backed by in-depth project financing knowhow. Together with strong connection networking and pragmatic pre and post project financing advice, it is further our advantages for the success stories of project owners / employers / holders.

By bringing and fueling breakthrough with above solutions from unique expertise, capabilities, funding tools, know-how project financing innovations, and project management, we remain dedicated to advancing governmental projects in the best interests of all involved parties.

It results that our project owners / employers / holders have been benefiting from a full set of tailored project financing for the government-to-government projects.

In summary, our success since inception in 2012 has been driven by our important and key factor via the top-down approach, working closely with individual country leadership to achieve notable outcomes in government-to-government projects. This approach ensures that our project owners / employers / holders benefit from tailored project financing solutions that propel their projects forward.

COLLABORATE WITH LOCAL SUB-CONTRACTORS APPOINTED BY PROJECT OWNERS / EMPLOYERS / HOLDERS

In advancing the fundraising, financing, execution, and completion of government-to-government (G-to-G) initiatives, Heritage group, in partnership with local collaborators, always prioritizes networking with project owners / employers / holders, as well as with their local sub-contractors.

By doing so, this approach has proven successful in adhering to project budgets, preventing cost overruns, and ensuring timely completion aligned with the time schedules set by Chinese state-owned EPC main-contractors and project owners / employers / holders / stakeholders.

STRATEGIC ALLIANCES AND PARTNERSHIPS

Our commitment to serving project owners / employers / holders is best exemplified by our provision of accessing to a comprehensive array of investment options and capabilities. Through strategic partnerships with Chinese and international advisors and co-investment partners, we offer accessing to project financing that complements our expertise in government-to-government projects.

Strategic alliances with key Chinese state-owned corporations enhance the competitiveness of our projects, ensuring priority access to China financing platforms.

Methodology

Since our establishment in 2012, Heritage group has adeptly managed various and multifaceted different types of Limited Partnership Funds (LPF) as both a General Partner (GP) and one of Limited Partners (LP), demonstrating and underscoring our commitment and dedication to the success of government-to-government projects.

LICENSINg compliance

Heritage Funds LPF has been managed by one of its General Partners Lee Kwok Wan, who works in accordance with Hong Kong Securities and Futures Commission with CE Number: AZL662 to carry out Type 9 (Asset Management) regulated activities under the Hong Kong Securities and Future Ordinance (Chapter 571 of the Laws of Hong Kong).

REGULATORY COMPLIANCE

Heritage Funds LPF is complied with the Limited Partnership Fund Ordinance (Cap. 637) of Hong Kong, where its limited partnership fund regime is registered in the form of limited partnerships in Hong Kong.

FUTURE EXPANSION

We are in the process of obtaining a Registered Fund Management Company (RFMC) license under the Securities and Futures Act (Cap.289) from the Monetary Authority of Singapore (MAS).

OUR china capital networks

Our strength lies in our network with China capital. Heritage Funds LPF has unlocked and formulated access to a strong & consolidated, workable, and bankable, and best-in-class structure and solution for our government-to-government projects.

Heritage Funds LPF always has had the privilege of collaborating with Chinese policy banks, Chinese financial institutions, Sinosure, China state-owned companies, and Chinese investors for our governmental projects.

In addition, we have worked with international accountants, attorneys, international banks & international financial institutions for our government-to-government projects apart from the financial supports from China.

Our complete turnkey solution from Heritage Funds LPF, is widely recognised among Chinese state-owned companies, project owners / employers / holders, and Chinese policy banks and Sinosure. It is accepted as loan securities to the government-to-government projects.

Overall our China connection network of contacts with China capital, is excellent.

Having the cornerstone of China capital is essential to the success of our Heritage group.

celebrated SUCCESS STORY: China money invests into kazahkstan

An exemplar of our proven approach is the investment in a 100,000-hectare of farmland for soya agricultural farming project in Kazakhstan by Chinese sovereign investors. This investment, facilitated through a series of offshore companies, mitigates local resistance to Chinese investment, complying with Kazakhstan’s laws and regulations.

Briefly, by diluting the China color of Chinese sovereign funds directly behind this investment, it has achieved through the operational structure of a series of offshore companies legally. Although it looks Chinese sovereign fund investors behind it, it results in reducing the impact of the local social and political and diplomatic image as a Chinese sovereign fund investment to invest into Kazakhstan:

- It highlights the characteristics of viable business operational model to be applied to overcome the local anti-emotion against China investment to acquire the Kazakhstan agricultural farming land.

- This investment cooperation model via equity as shareholders, it works well and it is guaranteed by Kazakhstan local laws. The laws of Kazakhstan allow local companies to invest in land as the capital of the joint venture. Therefore, the special purpose vehicle (SPV) as General Partners (GP) together with its Chinese sovereign investors as Limited Partner (LP), jointly participates in the shares of this investment.

- Such legal ownership of this special purpose vehicle (SPV) for this agricultural farming investments has been compliant with local laws and regulations.

- It succeeds to have an accumulated capital investment, i.e., land, equipment, seeds, fertilizers, and water irrigation systems at US$700 million in the first phase.

- The local people are responsible to organize production, and farming implementation.

- The Chinese team works under this special purpose vehicle (SPV) to provide technical support and management consulting within the “localized” operational framework.

- It manages a portfolio of more than 100,000 hectares of prime agricultural land suitable for soya, grains, oilseeds and pulses crops.

fund commitment

Heritage Funds LPF initiates, offers and provides bridging finance of up to 15% to project owners / employers / holders, and raise the remaining capital from other Chinese investors and Chinese policy banks, under the insurance covered by Sinosure.

We have strategic partnerships with some Chinese key state-owned corporations. Our sole purpose is to enhance the readiness and competitiveness of our governmental projects to be in the priority list under the credit line of China financing platform.

By working with Chinese co-investors, the Chinese governmental investment agencies, and Chinese banks, we offers a complete range of project financing services to restructure the non-performing loans and distressed assets for the project owners / employers / holders, it is one of the expertise areas for our Heritage group.

By taking advantage of our top level of financing networks in China, Heritage Funds LPF has worked into the following sectors for the project financing for governmental projects:

solid shareholders with china networks

The shareholders of Heritage group via Sino Pride Investments Ltd are structured, backed and supported by Chinese prominent shareholders with investment leadership network in Beijing and its Hong Kong partners, such solid shareholders have complementary advantages. Heritage Funds LPF does not solicit or accept retail investors.

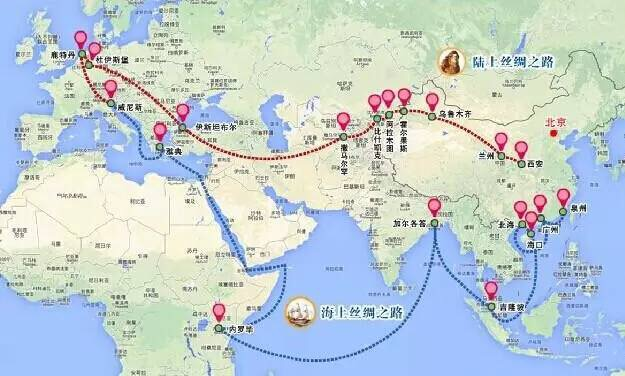

Act as a hitter to “Belt & Road” initiative

Above method of operation about the large-scale infrastructure projects, it makes Heritage group further success with high execution efficiency. Such success is a testament to the significance and potential for the government-to-government projects along with its reach to the tendrils of the China “Belt & Road” initiative together with the project owners / employers / holders.