Unique and Distinctive Fund Models

We do this one right thing, and we do it well.

This is exactly our niche. We only focus on achieving what matters we pursue our passion on this fund model.

We harness both the breadth and depth of our this fund model to deliver an elevated level of personalized project financing for the government-to-government projects.

ingredient

Our enduring commitment under the platform of Heritage Funds LPF is the vital, bold, and audacious ingredient for our funding model. We are doing what we take to win for all parties concerned. We connect China capital with the opportunity for our government-to-government projects with the project owners / employers / holders.

Our project financing model is best positioned to transform our government-to-government projects into project execution successfully within the budget by given the time frame.

fund structure

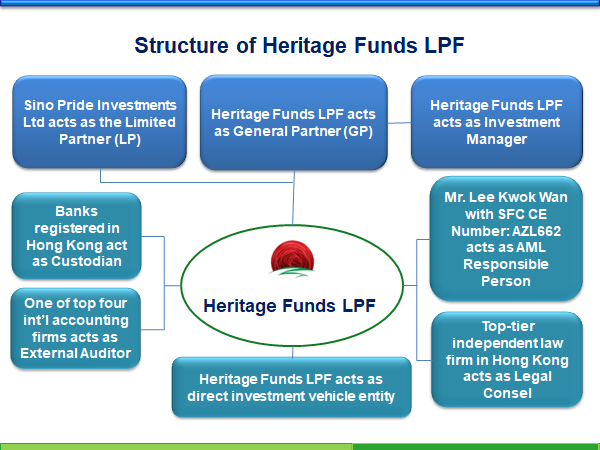

Heritage Funds LPF is always structured as the fact that we are the General Partner (GP) and one of the Limited Partners (LP) whilst our Chinese strategic Limited Partners (LP) have been our co-investors.

We are one of leading providers of “one-stop” project financing service under the China financing platform for our project owners / Employers / holders. We have an extensive China and international network of Limited Partners (LPs) as being proven track record.

heritage Funds LPF

Heritage Funds LPF is governed by its institution. The funds have been managed by one of its General Partners Lee Kwok Wan, Mr. Lee works in compliance with Hong Kong Securities and Futures Commission with CE Number: AZL662. Our objective is to ensure carrying out Type 9 (Asset Management) regulated activities under the Hong Kong Securities and Futures Ordinance (Chapter 571).

Heritage Funds LPF is fully compliant with the Limited Partnership Fund Ordinance (Cap. 637) (“the Ordinance”) for the establishment of a limited partnership fund regime for private funds to be registered in the form of limited partnerships in Hong Kong.

THE Registered Fund Management Company (“RFMC”)

We also are in the process of applying for the Registered Fund Management Company (“RFMC”) license under the Securities and Futures Act (Cap.289) (“SFA”) by the Monetary Authority of Singapore (“MAS”).

Then, our project financing activities not only are licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong, but they also are licensed and regulated by the Monetary Authority of Singapore (MAS) in Singapore once it has been approved by MAS.

Fund Pools

Currently, the fund pools of Heritage Funds LPF are with Bank of China Hong Kong.

investment managers

The partners of the investment managers within Heritage Funds LPF, have many years of collective experience with an in-depth knowledge of assets, Chinese state-owned companies, governmental projects, people, and trends.

The Fund managers are recognised for their strategic insight and vision. Heritage Funds LPF enters into an investment management agreement with the fund managers. They manage the funds.

It is the fund for the project management exercises under the platform of Heritage Funds LPF for our government-to-government projects.

funding source & its partnerS AND ITS CO-INVESTORS

The fund is primarily from China state owned companies, subsidiaries of Chinese policy banks & institutional investors and it includes other investors from China and Hong Kong.

Heritage Funds LPF works with Chinese and international financial institutions to jointly set up funds, and we manage the entrusted government-to-government projects.

Heritage Funds LPF initiates offering private equity funds. We put the bridge financing of project ownership for no more than 15% into the project. We continue carrying out our interest arrangements. It raises the remaining capital of 85% from other Chinese investors and Chinese policy banks with the insurance to be covered by Sinosure.

Heritage Funds LPF has strategic partnership with some Chinese key state-owned corporations to work with the governmental projects.

The sole purpose is to enhance our governmental projects with readiness and competitiveness for our project owners / employers / holders to be in the priority list under the credit line of China financing platform.

Heritage Funds LPF offers a complete range of financial services for having the lowest cost of project financing for our project owners / employers / holders.

We work either directly with our project owners / employers / holders, or through recognized local agents. Our project financing network well links with Chinese policy banks, Chinese financial institutions, Sinosure, and Chinese investors. The linkages of this connections, are excellent and solid as rock.

Investment criteria

Heritage Funds LPF works with selected strategic Chinese and international equity partners on a case-by-case basis by utilizing its financial ability, unique expertise, and execution skill to invest into its government-to-government projects. It directly participates into the investments in line with the Limited Partnership Agreement (LPA) under the investment structure model for the government-to-government (G-to-G) project. The objective is to provide investors with a high overall rate of return.

For example, there are three key investment criteria:

- the majority of the shares of the project, should be owned by Chinese companies whilst the local project owners have the minority of the shares of the project,

- the major shareholder of the project owners, has to buy it back within 5-8 years period and

- we only invest into the project with minority up from 15% to 40% of the total share of the project.

Apart from working based on a rigorous bottom-up fundamental approach, the fund plays a role as a catalyst by doing more creative things, i.e.

One of the methods of pioneering innovative transactions is to focus on the government-to-government projects. The local government can provide Chinese investors with the reasonable volume or quota of the resources to be needed by Chinese investors. It has no cash for deposit to be paid in advance for the local projects it intends to kick off. The financing capacity of the local government is limited. It could not make the investments by cash.

Heritage Funds LPF as the General Partner (GP) and one of Limited Partners (LP), will come in to seal the deal for the physical project. It will make cash injection of the reasonable portion of the investment into the project. The remaining portion is to be financed by Chinese investors / operators / contractors as the Limited Partner (LP) with the insurance covered by Sinosure under the backing by Chinese banks or Chinese private equity funds.

How does Heritage Funds LPF earn?

Heritage Funds LPF charges the management and performance fees, as outlined in the Fund’s Information Memorandum. Our fees vary and are negotiable. The fee rate decreases at higher project asset levels.

summary

Overall, China is changing. Its economic growth is increasingly driven by innovations and investment in technology, data and science. They are on their way to becoming an integrated part of the global financial system. China is getting more sophisticated. Chinese companies are developing. It leads to the fact that they are getting much more sophisticated in their approach to the activities in their expansion and acquisitions and investment abroad.

Heritage group with Heritage Fund LPF, is on the table for advising on these type of deals with the Chinese investors. Heritage group can do better than others to help them to get it done more professionally, profitably, effectively, and efficiently, i.e., by testing its value-creation hypotheses against a range of scenarios the Chinese investors could face.